In case you are looking for a property in the DHA Phase 4 Islamabad, you might find the two categories of common sectors: Overseas sectors and General sectors. For purchasers, investors, and prospective homeowners, it is vital to know the difference between the Overseas and General Sectors as the differences can influence the pricing, the change of location, the request for resale, and even the value going by the length of time. This manual explains how different they are so you can decide which one meets your needs the most.

What do Overseas Sectors mean in DHA Phase 4?

Overseas sectors are usually promoted for overseas Pakistanis and expatriate buyers who are in search of a safe investment option with a strong demand. In a number of DHA projects, the word “Overseas” denotes a certain group of sectors or allocations that have been designated, rather than a different kind of property ownership.

Typical traits of General sectors

- More variety in plot types and price points, depending on location.

- Strong option for families planning to build sooner and live in the area.

- Resale activity can be more frequent due to a larger local buyer base.

Key differences in Overseas vs General Sectors

1) Market perception and demand

The major difference of the General Sectors vs Overseas Sectors is most of the time just a matter of perception. An Overseas sector can have a “premium” image that can be a reason for higher asking prices. While a General sector may be more attractive to end users, which thus can lead to a more active resale trend, especially for well-located streets and plot categories.

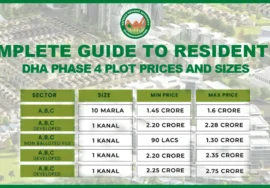

2) Pricing and premium trends

Quite often an Overseas sector can be priced higher for the same plot sizes due to branding, perceived exclusiveness, and investor demand. General sectors have more budget flexibility which is good for buyers to enter DHA Phase 4 at different price levels. The real price differences depend on the location of the plot, the development stage, and the amenities nearby.

3) Buyer profile

Different areas (Overseas vs. General) have different kinds of buyers. Overseas sectors mainly attract overseas Pakistanis, expats, and investors who prefer premium positioning and long term holding. While General sectors, on the other hand, attract a much wider variety of the mix that includes local families, builders, and short to mid-term investors. The main point of difference between Overseas and General Sectors is the question of future buyers. As a result, that factor significantly affects liquidity.

4) Resale and liquidity

Generally, local buyers are more active in general sectors, which give them larger pools of local buyers and thus easier resales in some cases. Although there might be strong resale opportunities in remote areas, the turnaround of investors and the premium pricing will have a greater impact on them. Liquidity is not only about which sector you are in, it is more about the demand for your particular price.

5) Suitability for end users vs investors

In case personal living is your aim, General sectors may look good as they offer more varied options and reasonable purchasing chances. On the other hand, if your goal is a high-end investment with a premium location, Overseas sectors might be interesting. The best choice of General versus Overseas Sectors will be determined by what kind of factors you focus most: lifestyle, budget flexibility, or premium resale expectations.

Which one should you choose?

Choose Overseas vs General Sectors depending on your goal

For living: General sectors may provide more options and entry points that are less complicated.

For investment: Overseas sectors might be more in line with the premium demand and long holding strategies.

Quick resale: Don’t focus that much on the label and more on plot location, street width, nearby facilities, possession status, and market activity.

Final thoughts:

The discussion of Overseas vs General Sectors in DHA Phase 4 Islamabad is not about. Which one is better in every case. It’s about combining your budget and timeline with the sector profile, buyer demand. And value drivers such as location and development pace. If you narrow down your choices to a few plots in both categories. It compare them side by side, you will be able to make a wiser, more profitable decision.